The Ultimate Home Buyer Checklist for Hudson County, NJ

Everything you need to consider before buying a home in Hoboken, Jersey City, or anywhere in Hudson County.

Buying a home in Hudson County is exciting, but it’s also one of the most competitive real estate markets in New Jersey. Between historic brownstones, gleaming new waterfront condos, and everything in between, there’s no shortage of choices, but navigating it all takes some local know-how.

Whether you’re a first-time buyer or trading up to more space, this Hudson County home buyer checklist walks you through each step of the process, with local insights you won’t find in a national guide.

Your Hudson County home search starts here.

Connect with The Jill Biggs Group - the #1 real estate team in New Jersey — and start finding the home that fits you best.

1. Get Your Finances Ready

Before you fall in love with a home, it’s important to know exactly what you can afford.

Check your credit score and review your savings for a down payment and closing costs.

Get pre-approved for a mortgage, not just pre-qualified. Sellers in Hoboken and Jersey City expect it before accepting an offer.

Compare lenders. Local lenders often know Hudson County’s condo and co-op requirements better than national banks.

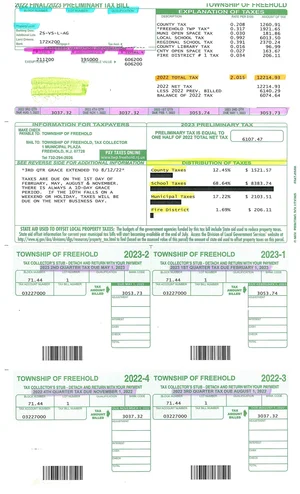

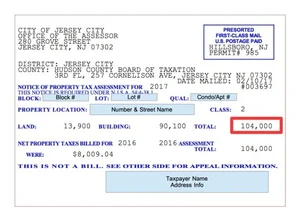

Understand total monthly costs. Beyond your mortgage, include property taxes, insurance, HOA or co-op fees, utilities, and parking if applicable.

Local Tip: HOA fees in newer Hoboken waterfront buildings can run $800 - $1,200/month, while older brownstones may have lower shared costs but higher maintenance.

2. Narrow Down Your Neighborhood

Each part of Hudson County has its own personality, commute, and price point.

Hoboken: Walkable, vibrant, and perfect for NYC commuters via the PATH or ferry.

Downtown Jersey City: Modern high-rises, river views, and a growing arts scene.

Journal Square & The Heights: More space, slightly better pricing, and easy transit access.

Weehawken, Union City, Bayonne: Great options for buyers looking for value without losing proximity to Manhattan.

Ask yourself:

How long do you want your daily commute to be?

Do you need a parking space or are you fine with a city permit?

How close do you want to be to parks, schools, or nightlife?

Local Tip: If you’re moving from NYC, check PATH and Light Rail schedules before you buy, commute times can vary dramatically by block.

3. Do a Deep Dive on the Property

Hudson County homes are full of charm, but also quirks. Before you commit, work with your agent to make sure you know what you’re buying.

Schedule a professional home inspection. For condos, request building maintenance records.

Check the building’s financial health. Ask for HOA meeting minutes, reserve funds, and if any special assessments are coming up.

Confirm all renovations were permitted. Unpermitted work is a common issue in older brownstones and multi-families.

Look for red flags. Water damage, foundation cracks, or outdated wiring (common in older Hoboken homes) can lead to costly fixes.

Local Tip: Many properties in flood zones require special insurance. Don’t skip checking FEMA maps before you make an offer.

4. Understand Flood Risk & Insurance

Waterfront living is part of Hudson County’s appeal—but it comes with added due diligence.

Check if the home is in a flood zone. You can verify this with the FEMA Flood Map Service Center.

Ask the seller for a flood disclosure. As of 2024, New Jersey law requires sellers to share known flood history or risk.

Get flood insurance quotes early. Even if it’s not mandatory, premiums have been increasing under FEMA’s new Risk Rating 2.0 system.

Request an elevation certificate. This shows the home’s height above base flood level and can impact your insurance cost.

Local Tip: Homes west of Park Avenue in Hoboken or on lower streets in Jersey City are more prone to flooding. A top-floor condo may cost more, but could save you money in insurance long-term.

5. Make a Smart Offer

When you find “the one,” act fast, but not without strategy.

Rely on your agent’s market expertise. In competitive areas, most homes receive multiple offers.

Include key contingencies. A home inspection, appraisal, and financing clause protect you if something goes wrong.

Be flexible with timing. Sellers appreciate buyers who can match their preferred closing date.

Don’t skip the attorney review. In New Jersey, this three-day period allows your lawyer to review and modify the contract before it becomes binding.

Local Tip: The Jill Biggs Group’s listings often go under contract in under two weeks. Having your financing lined up and deposit ready helps you move just as quickly.

6. Prepare for Closing

Complete your home inspection repairs (if any).

Secure homeowners and flood insurance.

Schedule a final walk-through to confirm the home’s condition matches the agreement.

Review all documents with your attorney. You’ll finalize title insurance, mortgage details, and municipal certificates (like smoke detector and CO compliance).

Local Tip: Hudson County property taxes vary widely by municipality, your agent can help estimate them before closing.

7. After You Move In

Keep all inspection and closing documents for future reference.

Set aside a home maintenance budget. Older properties in Hoboken or Jersey City often need regular upkeep.

Explore local services. The Jill Biggs Group can connect you with trusted contractors, painters, movers, and designers.

Enjoy your new neighborhood! From brunch spots on Washington Street to skyline views in Weehawken, you’re living in one of the most exciting parts of New Jersey.

Hudson County Buyer FAQ

What are the HOA or co-op fees, and what do they include?

In Hudson County, monthly HOA or co-op fees can vary widely depending on the building’s size, age, and amenities. Some newer high-rises in Hoboken and Jersey City include costs for concierge services, gyms, and parking, while smaller or older buildings might only cover maintenance and water. Always review the association’s financials, reserve funds, and bylaws before buying. This helps ensure the building is well-managed and financially stable, something your agent can help you assess.

Are there upcoming assessments or renovations in the building?

Special assessments are additional fees charged to residents to pay for major repairs or capital improvements such as roof replacements, façade repairs, or elevator upgrades. Before you buy, ask if any are planned or recently approved. A well-funded HOA or co-op will often have money in reserves for these projects, while underfunded ones may pass the cost to owners. Knowing this upfront helps you avoid surprise expenses after closing.

What’s the commute like to NYC or Jersey City’s business district?

Hudson County is known for its quick access to Manhattan, but commute times vary by neighborhood. Hoboken offers fast PATH and ferry options, while areas like The Heights or Weehawken may require bus or Light Rail transfers. Before committing to a home, test your commute during peak hours and explore parking or permit requirements if you plan to drive. Many buyers choose their neighborhood based on their daily commute, and The Jill Biggs Group can help you find a home that balances work, lifestyle, and convenience.

How much are the property taxes and insurance likely to increase?

Property taxes in Hudson County differ from town to town and can fluctuate with reassessments or home improvements. Your agent can provide recent tax records and help estimate future adjustments. Also consider homeowner’s and flood insurance. In some waterfront areas, flood insurance premiums have risen under FEMA’s Risk Rating 2.0 program, so getting early quotes is smart. Ask your lender or insurance agent to estimate total monthly costs, not just your mortgage. This helps you budget accurately and avoid surprises.

Visit our FAQ page for more answers to common Hoboken and Jersey Cuty Home buyer questions.

Final Thoughts

Buying a home in Hudson County can feel overwhelming, but with the right preparation (and the right agent), it doesn’t have to be. From financing and inspections to flood risk and closing day, having a trusted local expert makes all the difference.

If you’re ready to start your search, The Jill Biggs Group is here to help you find the perfect home, whether it’s a Hoboken brownstone, a Jersey City condo, or a Weehawken townhouse with skyline views.